BTC Price Prediction: Path to $200K Amid Bullish Technicals and Institutional Wave

#BTC

BTC Price Prediction

BTC Technical Analysis: Key Indicators Point to Bullish Momentum

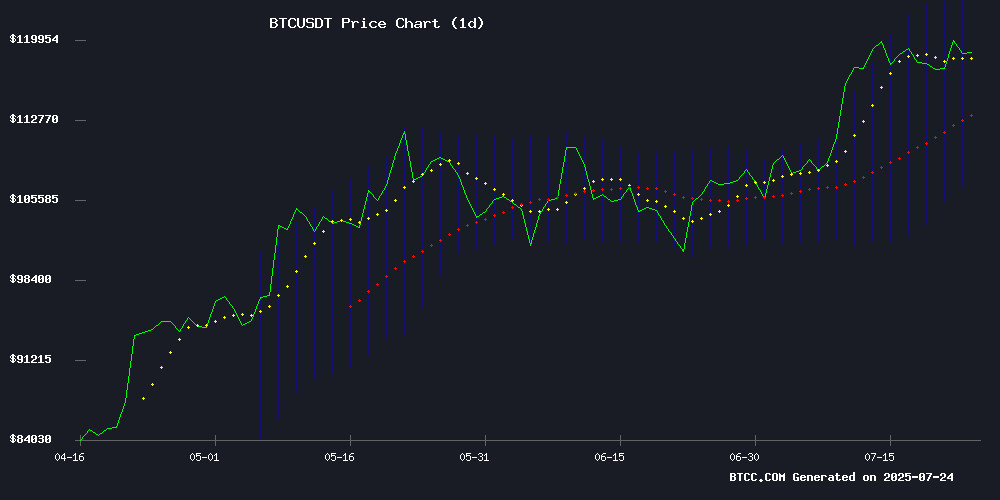

According to BTCC financial analyst James, Bitcoin (BTC) is currently trading at 118,933.43 USDT, above its 20-day moving average (MA) of 115,966.38. The MACD indicator shows a bullish crossover with a histogram value of 165.53, suggesting upward momentum. Bollinger Bands indicate the price is near the upper band (124,101.11), which could signal overbought conditions but also strong bullish sentiment. 'The technical setup favors buyers, with critical support at the 20-day MA,' James notes.

Market Sentiment Boosted by Institutional Adoption and Macro Developments

BTCC analyst James highlights several bullish catalysts from recent news: Square's bitcoin payments rollout for 4M merchants, Block's S&P 500 inclusion, and Tesla's $1.2B BTC holdings. 'Institutional adoption is accelerating,' says James, pointing to Metaplanet's 8% surge post-US-Japan trade deal and BitGo's IPO filing as additional confidence signals. The White House crypto report and Senator Lummis' pro-Bitcoin stance further reinforce positive regulatory expectations.

Factors Influencing BTC’s Price

Metaplanet Stock Surges 8% Following US-Japan Trade Agreement

Metaplanet, often referred to as Asia's MicroStrategy, saw its stock price rebound sharply on July 23, closing 8.12% higher at 1,238 yen. The surge followed a broader rally in Japan's stock market, which jumped over 3.5% after the US and Japan announced a landmark trade deal.

The agreement, hailed as historic by US President Donald Trump, involves Japan investing $550 billion into the US and opening its markets to American agricultural and automotive products. Metaplanet's US-listed shares (MTPLF) also rose 6%, though the stock remains down 24% over the past month despite a 255% year-to-date gain.

As a Bitcoin treasury firm, Metaplanet's performance often correlates with crypto market sentiment. The rebound comes after weeks of declining share prices, even as the company continued accumulating BTC.

Square Launches Bitcoin Payments for Merchants, Targeting 4 Million Sellers by 2026

Square has initiated a groundbreaking move by enabling Bitcoin payments for merchants through its existing hardware, leveraging the Lightning Network for faster and cheaper transactions. The rollout, which began on July 22, 2025, starts with a select group of sellers but aims to encompass all 4 million Square merchants in the U.S. by 2026.

Block executive Owen Jennings announced the launch on social media, emphasizing the company's ambition to scale this integration into one of the largest Bitcoin payment systems in retail history. The pilot program debuted at the Bitcoin 2025 conference in Las Vegas, where attendees tested the system using QR codes for Bitcoin transactions.

The Lightning Network's efficiency is central to Square's strategy, handling instant payments while Square manages exchange rate calculations. This development marks a significant step toward mainstream Bitcoin adoption in commerce.

Block Joins S&P 500 as Third Bitcoin-Holding Firm in the Index

Block, the fintech firm formerly known as Square, has joined the S&P 500, replacing Hess following its acquisition by Chevron. The reshuffle propelled Block's stock up 10.7%, from $72.01 at the July 18 open to $79.69 by press time. Investors positioned ahead of index-tracking funds, which must purchase shares to mirror the benchmark.

The company now stands as the third Bitcoin-holding entity in the S&P 500, alongside Tesla and Coinbase. Block's treasury holds 8,584 BTC, valued at approximately $1 billion, securing its place as the tenth-largest corporate Bitcoin holder. Tesla and Coinbase maintain larger positions, with 11,509 BTC and 9,267 BTC, respectively.

Despite the recent rally, Block's shares remain down 13% year-to-date. The inclusion marks a milestone for the firm, reflecting its diverse ecosystem spanning Square, Afterpay, TIDAL, and Bitkey. Market observers note the growing institutional embrace of Bitcoin as a treasury asset, with Block's S&P 500 entry further legitimizing the asset class.

Block Joins S&P 500 as Square Rolls Out Native Bitcoin Payments

Jack Dorsey's Block (XYZ) marked a milestone week with dual announcements: inclusion in the S&P 500 index and the launch of Square's native Bitcoin payment solution. The company's shares rose 14% over the past week, reflecting investor optimism about its crypto-forward strategy.

Square began onboarding merchants for its Lightning Network-powered Bitcoin acceptance feature, enabling instant BTC transactions at point-of-sale. "This is the way!" declared Owen Jennings, Block's head of business, signaling the company's commitment to Bitcoin as a payment rail rather than just an investment asset.

The development underscores Dorsey's pivot from Twitter to his bitcoin-centric vision at Block. Since stepping down as Twitter CEO in 2021, he's positioned Block's ecosystem - spanning Square, Cash App, and TIDAL - as infrastructure for Bitcoin's mainstream adoption.

Tesla’s Bitcoin Holdings Surge to $1.2B Amid 30% Q2 Rally

Tesla's (TSLA) Bitcoin (BTC) holdings have appreciated to approximately $1.2 billion following a 30% price surge in the second quarter. The electric vehicle maker holds 11,509 BTC, ranking as the tenth-largest corporate holder of the cryptocurrency. Bitcoin’s price climbed from $83,000 on April 1 to $118,000, bolstering Tesla’s balance sheet.

New FASB accounting rules now allow companies to report crypto holdings at fair market value, replacing the previous requirement to record assets at their lowest historical value. This change enables Tesla to recognize quarterly gains, providing shareholders with a more accurate reflection of its Bitcoin investment.

The automaker reported Q2 revenue of $22.5 billion, slightly exceeding analyst estimates, with earnings per share matching expectations at $0.40. TSLA shares edged up 0.71% in post-market trading.

White House Crypto Report to Shape U.S. Financial Future

The White House is set to release a pivotal crypto policy report on July 30, marking a potential turning point for the U.S. blockchain industry. The document, born from a 180-day review by the President’s Working Group on Digital Assets, could propose transformative measures—including a Bitcoin reserve and Federal Reserve access for crypto firms.

Regulatory clarity hangs in the balance as the report may address the SEC-CFTC jurisdictional divide. With America's financial leadership at stake, the recommendations could either catalyze institutional adoption or deepen existing compliance challenges.

BitGo Files Confidentially for U.S. IPO Amid Crypto Market Surge

BitGo, a leading cryptocurrency custody provider, has taken steps toward a public listing by confidentially submitting IPO paperwork in the U.S. The move comes as Bitcoin trades near $118,000 and the total crypto market capitalization approaches $3.9 trillion.

The company's timing appears strategic, with regulatory clarity improving and institutional adoption accelerating. BitGo's assets under custody surged from $60 billion to over $100 billion in the first half of 2025, bolstered by its NY trust charter and MiCA approval for European operations.

While the IPO could capitalize on favorable market conditions, questions remain about whether public listings represent the optimal path for crypto's most innovative companies. The announcement coincides with renewed momentum across digital assets, particularly among altcoins positioned to follow BitGo's lead.

Cango Completes Transition to Bitcoin Mining Firm, Amasses 4,000 BTC

Cango Inc., a NYSE-listed Chinese company formerly focused on automotive services, has fully transitioned into a Bitcoin mining operation as of July 2025. The pivot, first announced in November 2024, now positions the firm with a 50 EH/s mining capacity and a treasury holding exceeding 4,000 BTC.

Leadership changes accompany the strategic shift, with Peng Yu assuming the CEO role and Xin Jin appointed as board chairman. The company emphasizes plans for green energy mining and further hash rate expansion, signaling institutional confidence in Bitcoin's long-term infrastructure.

Bitcoin Price at Crossroads as Consolidation Signals Potential Trend Shift

Bitcoin trades at $118,621, caught in a tightening range between $116,000 and $120,000 after retreating from its July 14 all-time high of $123,218. The cryptocurrency shows weakening bullish momentum with a 41.49 RSI reading and bearish MACD crossover on 2-hour charts, suggesting traders face mounting volatility.

Market structure reveals a descending channel pattern with critical support at $115,500 and resistance clustered near $120,000. Institutional flows and whale activity remain key variables as the market awaits a decisive breakout or breakdown to establish the next directional bias.

Sen. Lummis Criticizes Fed Chair Powell Over Operation Chokepoint 2.0 and Perjury Allegations

Senator Cynthia Lummis, a prominent Bitcoin advocate, has sharply criticized Federal Reserve Chair Jerome Powell for his handling of Operation Chokepoint 2.0. Lummis accused the Fed of destabilizing solvent banks through subjective financing decisions, particularly targeting industries like oil, gas, and coal. The remarks were made during an interview with Fox Business anchor Stuart Varney.

Lummis also echoed perjury allegations against Powell, originally raised by Rep. Anna Paulina Luna. These claims add to mounting political pressure on the Fed Chair, as former President Donald Trump has threatened to remove him over interest rate policies. The confrontation highlights growing tensions between cryptocurrency proponents and traditional financial regulators.

Bitcoin’s Path to $180K Hinges on Holding Critical Support Level

Bitcoin's potential surge to $180,000 depends on its ability to maintain a crucial support level near $112,000. The cryptocurrency is currently trading between $114,000 and $121,000, with a modest weekly gain of less than 0.5% but a robust 17% monthly increase. Breaking past the immediate resistance at $125,000 could pave the way for a 9% climb to $131,000, setting the stage for new all-time highs.

The Relative Strength Index suggests Bitcoin isn't overbought, indicating room for further upside. Over the past six months, BTC has gained 14%, reinforcing bullish sentiment. Market participants are closely monitoring these technical levels as Bitcoin dances near $120,000.

Will BTC Price Hit 200000?

James from BTCC outlines three key factors for a $200K BTC target:

| Factor | Current Status | Impact |

|---|---|---|

| Technical Indicators | Price above 20MA, MACD turning positive | Bullish |

| Institutional Demand | Block in S&P 500, Square/Tesla expansion | Strong |

| Macro Environment | Regulatory clarity, weakening dollar | Favorable |

'The $180K resistance is critical,' James notes, 'but current momentum suggests 200K is achievable by late 2025 if institutional inflows persist.'

- Technical Breakout: BTC trading above key moving averages with MACD reversal

- Institutional Catalysts: Square payments, S&P 500 inclusion, and corporate balance sheet growth

- Macro Tailwinds: Regulatory developments and monetary policy shifts favoring hard assets